Just days after I wrote about the focus at Sears (SHLD) being store redesigns, not non-core asset sales, we get a timely SEC filing from the company announcing its interest in bidding for home furnishings retailer Restoration Hardware (RSTO). The comments from Sears are very interesting. Chairman Eddie Lampert has been eyeing the company since June, and this month alone has increased his stake by 3.4 million shares, bringing SHLD's total ownership to 5.3 million shares, or 14%.

In case you didn't read the filing, here is what we know. Lampert indicated his interest in acquiring or partnering with RSTO in June, but he did not meet with management to discuss a deal until October. At that point he offered $4.00 per share for RSTO, which was 40% above where the stock was trading. RSTO indicated that price was too low, but Lampert insisted on conducting due diligence before raising his bid.

On November 8th, RSTO announced a management led buyout (along with private equity firm Catterton Partners) in a deal worth $6.70 per share in cash. However, RSTO stated publicly that it will consider other offers until December 13th, and that it plans to actively solicit such alternative deals during that time. Lampert appears eager to sign a confidentiality agreement in order to look under the hood and perhaps make a revised offer.

Obviously, a lot is going on here. The market's reaction has been largely negative, but it appears that is mainly based on the short term retail environment being bad for home furnishings. Lampert is clearly not concerned with how well RSTO will do in Q4 or 2008. He is likely looking long term, trying to come up with ways to strengthen the product and profitability of Sears merchandise in a more normal retail environment.

So what is the rationale for an interest in RSTO? To me, it's not that complicated. Lampert has said repeatedly since he took over Kmart, and subsequently bought Sears, that his first priority was not growing the company, but increasing profits. Retail experts and many investors have complained about lack of store growth and negative same store sales growth, but they are missing Lampert's point.

See, Lampert doesn't think the problem is lack of sales or not enough customers. Sears has thousands of stores and more than $50 billion in annual revenue. The problem is, despite such a strong retail presence, the company makes very little money. In his mind, he can do one of two things. One, open more stores that hardly turn a profit, or two, maximize profits from the existing store base and then figure out how best to grow the business. Not surprisingly, he prefers the latter because he is an investor in the business. Remember, long term stock prices are dictated by profits, not sales.

How would RSTO fit into this model? First, Lampert is buying a cheap retailer during a time when home furnishing sales are weak, so he has upside with the current strore base (100 plus locations). More importantly, he can add better merchandise to thousands of his existing stores. Not only could those products potentially sell better than the ones they have now (RSTO's product is a very high quality), but they are far more profitable because Sears would own the suppler.

Lampert seems to be focused on building store redesigns around promoting certain well known brands, many of which Sears actually owns (think Kenmore, Land's End, etc). If the goal is to maximize profits, this model makes the most sense. Consumers have multiple avenues to purchase company-owned products. You can buy Land's End clothing through the catalog or in Sears stores. There is tremendous potential to boost sales and have the cost structure lower at the same time. The same could be done with Restoration Hardware.

So, although the reaction to this news has hardly been positive, I think that is simply because people don't believe in Lampert's strategy. However, if you are investing in Sears alongside him, you have to be pleased that he has done exactly what he said he would do. Either investors want in to the plan, or they don't. That's what makes a market.

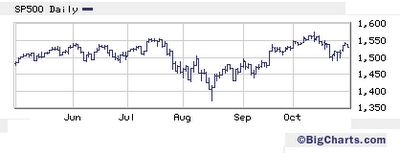

Whether or not the plan works remains to be seen, but Lampert's track record to date has been pretty impressive. Although the stock is down significantly from its highs, along with all other retail stocks, investors need to keep in mind it was $15 per share when he started this whole retail endeavor. As for the most recengt news, we should know the fate of RSTO shortly, as the company has about three more weeks to field competing offers.

For those who were wondering if Lampert was up to anything on the acquisition front, it was very interesting to learn that he has been eyeing RSTO since June. Not only that, but he likely first bought shares back then at prices below $3, versus the $7 price tag today (the SEC filing noted that SHLD has owned 1.9 million shares for longer than 60 days). That kind of return is exactly the type of thing Lampert fans have been hoping for and RSTO might just be the beginning.

Full Disclosure: Long shares of Sears Holdings at the time of writing