Overstock.com (OSTK) has long been a volatile and controversial stock, at least in part due to its founder and former CEO, Patrick Byrne. Although I don‘t short stocks very often and do so even less in client accounts (most of the assets I oversee are in retirement accounts, where shorting is not allowed), Overstock is one of those businesses that makes for an attractive short at times; a much-hyped business with relatively poor economics that loses money. Every so often it sees a huge spike in stock price, only to fall back to earth. And then the process repeats itself at some point. Here is a chart of OSTK shares from 2003 through 2019:

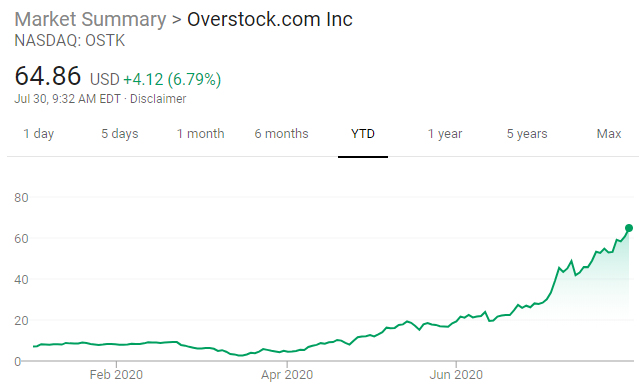

During the pandemic, e-commerce businesses have seen an acceleration in sales growth and stock prices have responded, with the likes of Amazon (AMZN), Etsy (ETSY), and Wayfair (W) surging. Overstock, despite being a secondary player, has once again seen its stock soar:

As I often do in situations like this, I checked to see what the borrow charge was to short OSTK (stocks with smaller floats often cannot be shorted due to a lack of available shares - or in other cases investors need to pay a fee to borrow the stock which is often high enough to negate any material gains you could earn). Interestingly, the borrow charge on OSTK right now is immaterial, so I am now short the stock. While this mania in tech-related stocks may not end anytime soon, which could spoil this particular trade (insert “the market can remain irrational longer than you can remain solvent” disclaimer here), I have little doubt that the intrinsic value of OSTK and the stock price have not moved in tandem during the last couple of months.

So how bad is the business? Well, free cash flow has been negative every year since 2015 (EBITDA negative since 2017). Revenue in 2019 was below 2015 levels. For Q1 2020, EBITDA and operating cash flow were both negative. As folks were working from home and needed to bulk up on home furnishings, OSTK saw Q2 revenue jump 109% year over year. EBITDA went from negative $20M in Q1 2020 to positive $39M in Q2 2020, as sales surged 122% quarter over quarter. This strength is likely temporary, as hard goods are typically not high frequency repeat purchases.

Overstock shares were trading for about $9 before the pandemic at the February market peak, bringing the market value gain over the last 5 months to roughly $2.5 billion. Even if Q2 2020 EBITDA was maintained in perpetuity, OSTK currently fetches a multiple of 17x EBITDA. That valuation might not seem crazy, until you consider that the brand is a second tier player, at best, and more importantly, maintaining sales at these rates over the long term is simply not reasonable. Further supporting a negative view on OSTK is the fact that the company has actively shopped the retail business to potential buyers recently and found no takers willing to offer a fair price.

Full Disclosure: Short shares of OSTK at the time of writing, but positions may change at any time