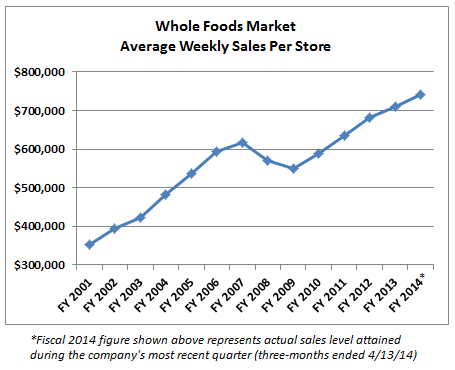

I wanted to briefly follow up my post from yesterday (The Death of Whole Foods Market is Likely Greatly Exaggerated) with a telling chart. The financial media has been reporting that Whole Foods Market (WFM) is being hurt by lower cost natural food grocery stores, thereby implying that the company has less brand loyalty and differentiation than some had previously thought. I would challenge the notion that WFM is losing customers to other stores. While it could happen in the future, the sales data show that WFM's sales per store are actually continuing to rise:

Not surprisingly, the growth in average weekly sales per store peaked in 2007 and dropped 11% during the 2008-2009 period. Customers came back quickly post-recession, however, enabling WFM to reach record sales per store just two years later in 2011. Not only have sales increased every year since, but they are continuing to rise this year. This is definitely a number to watch as times goes on to gauge potential customer defections, but the idea that Whole Foods stores are beginning to really struggle is completely unfounded if you look at the data. It might make for a good story, but it's not very helpful for investors.