The drug sector has been a tough place to invest in recent years as the FDA has become more and more strict, not only in approving new drugs but also with respect to labeling requirements for existing ones.

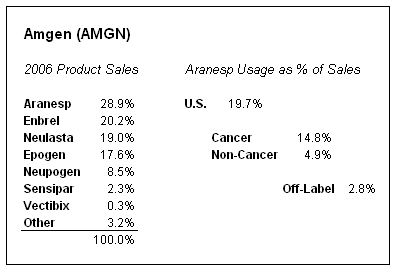

Last year, new warning labels essentially crippled the anemia drug franchise at Amgen (AMGN), and a recently released study for Vytorin, a cholesterol drug from Merck (MRK) and Schering Plough (SGP), has investors worried. The market has slammed the two stocks, after study results showed that Vytorin (a combination drug composed of Zocor and Zetia) was no more effective than Merck's Zocor in reducing the risk of heart disease. This is important because Zocor is available in generic form, while Vytorin is a new, more expensive medication.

Zetia and Vytorin, both products of a cholesterol joint venture between Merck and Schering, netted the two companies about $5 billion of revenue in 2007, but that business is coming to question. If Vytorin is not as helpful as the companies have been claiming, scripts could move heavily toward generic Zocor and significantly impact the profits derived from the joint venture.

One of the more interesting things about this story is that the drug trial in question (called "Enhance") actually did show that Vytorin was better than generic Zocor at reducing levels of so-called "bad" cholesterol. That important point has been widely ignored, however, because of worries that Merck and Schering have been touting Vytorin's ability to perhaps slow progression of disease. If marketing materials have to tone down their claims, Vytorin sales would be hurt.

All of this said, there are always drug studies that show less positive effects than others. Not every patient sees benefit from a drug, but just because some people do and others don't does not mean these drugs should be pulled from the market. Often times drug companies don't even know exactly why drugs work, let alone why they do for some people and don't for others. As long as some patients see benefits, their doctors will likely still prescribe them.

The FDA has gotten very strict about studies that show possible harm to patients, even if it is in very small numbers. The important thing about the Vytorin study is that not only is the drug not harmful, but it still is better than the generic at reducing cholesterol. As a result, this trial is not going to result in Vytorin being pulled from the market. Rather, it will likely lead to some people who found success on generic Zocor going back to it, with the belief that paying the extra money for Vytorin might not be worth it. For those who see lower cholesterol levels with Vytorin, there is no reason to think they will stop taking the medication.

The stock prices of Merck and Schering, meanwhile, have gotten absolutely crushed as this news has come out. The cholesterol joint venture accounts for 20% of sales for Schering Plough and 10% for Merck. With Schering's recent acquisition of Organon Biosciences, that number should drop to 15% in 2008. Meanwhile, SGP shares are down 25% since the news hit, with MRK dropping 20%. In total, the two companies have lost $35 billion in market value despite the drugs generating only $5 billion in annual sales. Even if both are pulled from the market (unlikely given what we know so far), the reaction would be overly harsh.

As a result, both of these stocks look like steals for long term investors. A pretty dramatic drop in scripts would still likely result in maybe a 50% decrease in Vytorin and Zetia sales, which amounts to $1.25 billion for each company. It appears that the dog's bark in this case is likely to prove much louder than its bite. I'm not saying this study is a non-issue, I merely think the market value loss we have seen is assuming much more of a profit deterioration for these two companies than is likely to occur.

In my view, based on current prices, Merck gets the slight nod over Schering for the following reasons:

1) Strong developmental product pipeline relative to the industry

2) Less of its core business relies on the cholesterol joint venture

3) Higher dividend yield (3.3% for MRK vs 1.3% for SGP)

4) Potential for incremental generic sales gains when some patients inevitably switch from Vytorin to Zocor (a Merck product)

Full Disclosure: Long shares of all the companies mentioned in this piece at the time of writing